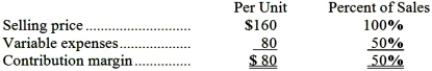

Data concerning Runnells Corporation's single product appear below:  The company is currently selling 6,000 units per month. Fixed expenses are $424,000 per month. The marketing manager believes that a $7,000 increase in the monthly advertising budget would result in a 100 unit increase in monthly sales. What should be the overall effect on the company's monthly net operating income of this change?

The company is currently selling 6,000 units per month. Fixed expenses are $424,000 per month. The marketing manager believes that a $7,000 increase in the monthly advertising budget would result in a 100 unit increase in monthly sales. What should be the overall effect on the company's monthly net operating income of this change?

Definitions:

Depreciation

The systematic allocation of the depreciable amount of an asset over its useful life.

Straight-Line Method

A method of depreciation that allocates an asset's cost evenly throughout its useful life.

Carrying Amount

The value at which an asset or liability is recognized on the balance sheet, calculated as its original cost minus depreciation or amortization.

Useful Life

The period over which an asset is expected to be available for use by an entity; or the number of production or similar units expected to be obtained from the asset by an entity.

Q3: The Stephens Leadership Center provides training seminars

Q5: To the nearest whole dollar, what should

Q11: What is the unit product cost for

Q16: Corio Corporation reports that at an activity

Q25: Dabney Corporation has provided the following production

Q26: If sales decrease by 500 units by

Q39: The process of assigning overhead cost to

Q44: The same constrained resource is used by

Q105: The difference between total sales in dollars

Q186: What is the total period cost for