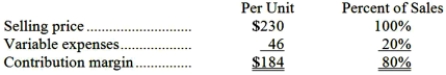

Data concerning Knipp Corporation's single product appear below:  Fixed expenses are $587,000 per month. The company is currently selling 4,000 units per month. The marketing manager would like to introduce sales commissions as an incentive for the sales staff. The marketing manager has proposed a commission of $16 per unit. In exchange, the sales staff would accept a decrease in their salaries of $57,000 per month. (This is the company's savings for the entire sales staff.) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 100 units. What should be the overall effect on the company's monthly net operating income of this change?

Fixed expenses are $587,000 per month. The company is currently selling 4,000 units per month. The marketing manager would like to introduce sales commissions as an incentive for the sales staff. The marketing manager has proposed a commission of $16 per unit. In exchange, the sales staff would accept a decrease in their salaries of $57,000 per month. (This is the company's savings for the entire sales staff.) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 100 units. What should be the overall effect on the company's monthly net operating income of this change?

Definitions:

Before-Tax Distribution

Refers to the allocation of income among individuals or entities before accounting for taxes.

Personal Income Tax

a tax levied on individuals or households based on their total annual income, with the tax rate typically increasing as income increases.

Sales And Excise Taxes

Taxes imposed on the sale of goods and services (sales tax) and specific goods like gasoline, cigarettes, and alcohol (excise taxes), typically used to generate revenue for governments.

Commodity Taxes

Taxes imposed on goods, often based on their value or quantity, used by governments to generate revenue or influence market prices.

Q4: Blore Corporation reports that at an activity

Q5: The desired profit according to the target

Q20: Malcolm Company uses a predetermined overhead rate

Q33: Daguio Corporation uses direct labor-hours in its

Q54: Yista Corporation uses a predetermined overhead rate

Q70: The total contribution margin for the month

Q117: To the nearest whole dollar, what should

Q145: Net operating income reported under absorption costing

Q158: Colasuonno Corporation has two divisions: the West

Q200: Last year, Holroyd Corporation's variable costing net