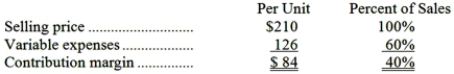

Data concerning Goulbourne Corporation's single product appear below:  Fixed expenses are $444,000 per month. The company is currently selling 7,000 units per month.

Fixed expenses are $444,000 per month. The company is currently selling 7,000 units per month.

Required:

Management is considering using a new component that would increase the unit variable cost by $2. Since the new component would improve the company's product, the marketing manager predicts that monthly sales would increase by 200 units. What should be the overall effect on the company's monthly net operating income of this change if fixed expenses are unaffected? Show your work!

Definitions:

Q12: The management of Ferriman Corporation would like

Q24: Relative profitability should be measured by dividing

Q45: A total of 30,000 units were sold

Q51: At an activity level of 9,200 machine-hours

Q65: Opinions on the effectiveness of the internal

Q67: In a job-order costing system, direct labor

Q114: The margin of safety percentage is computed

Q124: The contribution margin for Product R was:<br>A)$48,750<br>B)$63,500<br>C)$51,000<br>D)$48,000

Q156: What is the total period cost for

Q196: Phillipson Corporation has two divisions: the IEB