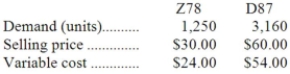

The constraint at Frayer Inc. is a key raw material. A total of 9,700 ounces of this constrained resource are available. Data concerning the company's two products, Z78 and D87, appear below:  Each unit of product Z78 requires 5 ounces of the constrained raw material; each unit of product D87 requires 2 ounces.

Each unit of product Z78 requires 5 ounces of the constrained raw material; each unit of product D87 requires 2 ounces.

Required:

a. In the present circumstances, which product is most profitable?

b. How much of each product should be produced?

c. The company is considering launching a new product whose variable cost is $157 and that requires 26 ounces of the constrained resource. What is the minimum acceptable selling price for the new product?

Definitions:

Company-specific Risk

A type of risk that affects a specific company or industry, distinguished from market-wide risk.

Risk-free Rate

The theoretical rate of return of an investment with zero risk, often represented by the yield on government bonds.

Market Risk Premium

The extra return over the risk-free rate that investors require to hold a risky market portfolio.

Beta

A measure of a stock's volatility in relation to the overall market; often used as a gauge of an asset's risk.

Q7: All of the following are principal provisions

Q18: Executive Training, Inc., provides a personal development

Q22: Doran Corp.has a current ratio of 6.Under

Q42: Which one of the following is an

Q54: The rationale for adding back the _

Q58: When calculating Basic earnings per share net

Q61: Which of the following items is consistent

Q89: Most financial statement analysis aims to assess

Q100: The company's contribution margin ratio is closest

Q201: To reach a target net operating income