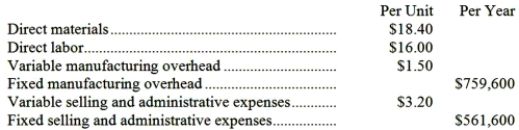

Qudsi Company makes a product that has the following costs:  The company uses the absorption costing approach to cost-plus pricing as described in the text. The pricing calculations are based on budgeted production and sales of 36,000 units per year.

The company uses the absorption costing approach to cost-plus pricing as described in the text. The pricing calculations are based on budgeted production and sales of 36,000 units per year.

The company has invested $580,000 in this product and expects a return on investment of 12%.

Required:

a. Compute the markup on absorption cost.

b. Compute the selling price of the product using the absorption costing approach.

c. Assume that every 10% increase in price leads to a 13% decrease in quantity sold. Assuming no change in cost structure and that direct labor is a variable cost, compute the profit-maximizing price.

Definitions:

Indirect Materials

Materials used in the production process that do not become an integral part of the final product and are not easily traceable to specific products.

Raw Materials

Basic substances or inputs in their natural, unprocessed, or minimally processed states used in manufacturing to produce finished goods.

Work in Process

Inventory that includes goods that are in the production process but are not yet completed.

Raw Materials

The basic substances in their natural, modified, or semi-processed state used as inputs for manufacturing.

Q11: Your boss would like you to estimate

Q12: Which of the following economic characteristics is

Q13: Heilmann Corporation would like to determine the

Q25: Creighton Corp. ,a textile manufacturer,reported net income

Q39: The payment of dividends would be classified

Q51: At an activity level of 9,200 machine-hours

Q57: Ribb Corporation produces and sells a single

Q65: The price elasticity of demand can be

Q86: In any decision making situation, sunk costs

Q177: The company's break-even in bundles is closest