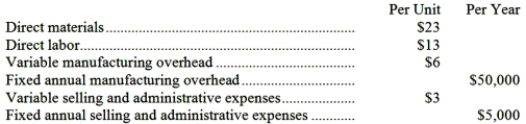

The management of Heimrich Corporation would like to set the selling price on a new product using the absorption costing approach to cost-plus pricing. The company's accounting department has supplied the following estimates for the new product:  Management plans to produce and sell 5,000 units of the new product annually. The new product would require an investment of $420,000 and has a required return on investment of 20%.

Management plans to produce and sell 5,000 units of the new product annually. The new product would require an investment of $420,000 and has a required return on investment of 20%.

Required:

a. Determine the unit product cost for the new product.

b. Determine the markup percentage on absorption cost for the new product.

c. Determine the target selling price for the new product using the absorption costing approach.

Definitions:

Controlling Interest

An ownership interest in an entity that gives the holder the power to direct or influence the management and policies of the entity through ownership of a majority of voting shares.

Deferred Income Tax Liability

A deferred income tax liability is a tax that is assessed or is due for the current period but has not yet been paid, pushing the obligation to future periods.

Operating Income

Income generated from normal business operations, excluding revenues and expenses from non-operating activities.

Income Tax Rate

The proportion of income that is subject to taxation for a person or a company.

Q10: When calculating the quick ratio,an analyst would

Q36: On December 31,2009,Loran Corporation reported a deferred

Q38: The issuance of debt would be classified

Q40: All of the following are primary events

Q48: Quality accounting information seeks to maximize relevance

Q54: What is the margin of safety in

Q68: Obtaining a competitive advantage by being the

Q75: Donmoyer Sales Corporation, a merchandising company, reported

Q149: The following information pertains to Clove Co.:

Q156: The conversion cost for April was:<br>A)$186,000<br>B)$100,000<br>C)$128,000<br>D)$122,000