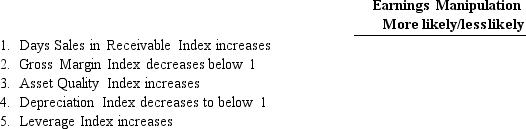

For each of the following factors,determine if the given change or level of that factor would lead an analyst to believe that managers of a firm are more or less likely to engage in earnings manipulation:

Definitions:

Definite Outcomes

Results or effects that are specific, clear, and unambiguous, often anticipated or expected in various contexts.

Temporal Discounting

A preference for immediate gratification over rewards that come later.

Risk Aversion

A behavioral tendency to prefer avoiding losses over acquiring equivalent gains, indicating a preference for certainty and safety.

Certainty Effect

The tendency for people to give greater weight to outcomes that are certain, compared to outcomes that are probable, often observed in decision-making under uncertainty.

Q4: The primary purpose of the balance sheet

Q9: Firms recognize the reduction in service potential

Q11: Which of the following is the correct

Q30: Normally,cash flows from financing will start using

Q36: Over the life of a firm,the capital

Q39: The net amount a firm would receive

Q43: Over the life of a firm,the capital

Q49: _ activities relate to the acquisition and

Q53: Norton Company reported total sales revenue of

Q62: Economic theory teaches that differences in market