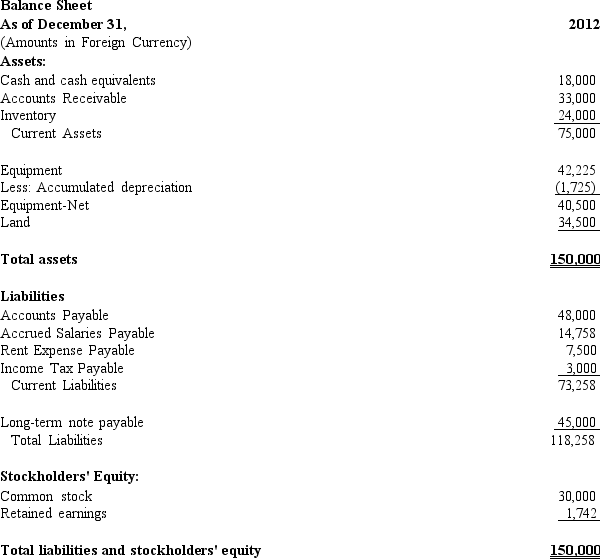

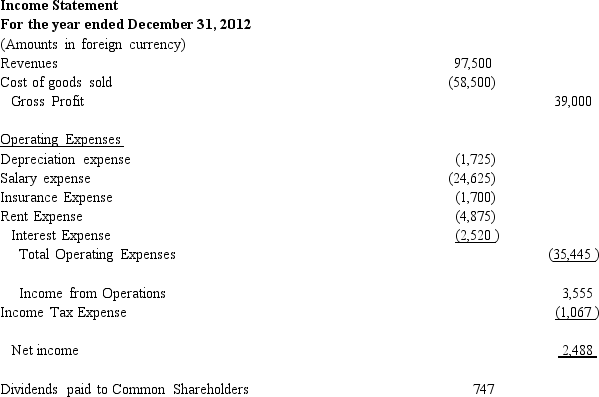

Below you will find the balance sheet and income statement of a US Corp.'s foreign subsidiary at the end of its first year of operations.The following exchange rates were in effect during the period:

Jan.1,2012 - $1 = 1FC

Dec.31,2012 - $1.70 = 1FC

The average exchange rate during the period was $1.40=1FC.The common stock was issued on January 1,2012.

Assuming that the foreign currency is the functional currency,translate the financial statements into U.S.dollars.

Definitions:

Debt Capital Structure

The composition of a company's liabilities and equity used to finance its operations and growth, particularly focusing on the proportion of debt used.

Target Capital Structure

The optimal mix of debt, equity, and other financing sources a company aims to achieve for financing its operations and growth.

Coupon Rate

The annual interest rate paid on a bond, expressed as a percentage of the face value, and received by the bondholders at specified intervals.

Flotation Costs

Expenses incurred by a company when it issues new securities, including underwriting fees, legal fees, and registration fees.

Q2: Companies value-to-book and market-to-book ratios may differ

Q6: Why is the dividends valuation approach applicable

Q9: Cash flow from operations indicates the amount

Q18: The quick acid test ratio contains all

Q21: All of the following are typically recognized

Q25: Using the information below,calculate the average total

Q25: For some transactions GAAP requires that value

Q44: Below is a condensed version of the

Q57: What information can a PEG ratio provide

Q57: One criterion that must be satisfied for