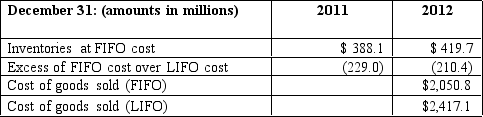

A large manufacturer recently changed its cost-flow assumption method for inventories at the beginning of 2012.The manufacturer has been in operation for almost 40 years,and for the last decade,it has reported moderate growth in revenues.The firm changed from the LIFO method to the FIFO method and reported the following information:

Calculate the inventory turnover ratio for 2012 using the LIFO and FIFO cost-flow assumption methods.Explain why the costs assigned to inventory under LIFO at the end of 2011 and 2012 are so much less than they are under FIFO.

Calculate the inventory turnover ratio for 2012 using the LIFO and FIFO cost-flow assumption methods.Explain why the costs assigned to inventory under LIFO at the end of 2011 and 2012 are so much less than they are under FIFO.

Definitions:

Now

The present time or moment.

Types Of Procedures

Various categories or methods of operations in computing and programming, often used to execute specific tasks or functions.

Declaration

A statement in programming that specifies the identifier, type, and sometimes the initial value of variables or functions.

Visual Basic Editor

A development environment from Microsoft used for creating, testing, and debugging code written in Visual Basic programming language.

Q2: For most firms,_ include cash and short-term

Q11: The CAPM computes expected rates of return

Q13: Accounting for the residual income in a

Q14: Assume that Zonk is a potential leveraged

Q26: If the market price of a share

Q37: Projected financial statements can be used to

Q51: All of the following are true regarding

Q54: The rationale for adding back the _

Q63: Many times an analyst will have to

Q78: Refer to the information for Net Devices