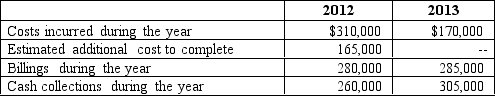

Magnum Construction contracted to construct a factory building for $545,000.The company started during 2012 and was completed in 2013.Information relating to the contract is as follows:

Required:

Required:

Record the preceding transactions in Magnum's books under completed-contract and the percentage of methods.Determine amounts that will be reported on the balance sheet at the end of 2012.

Definitions:

Income Statement

A financial statement that summarizes a company's revenues, expenses, and profits or losses over a specific period.

Contribution Format

An income statement format that separates fixed and variable costs to illustrate their impact on net income.

Income Statement

A financial report that shows the revenue, expenses, and profits (or losses) of a company over a specific period of time.

Degree of Operating Leverage

A ratio that quantifies the sensitivity of a company's operating income to its sales volume, indicating the impact of fixed and variable costs.

Q3: If Ashley Company accounts for the investment

Q8: Which of the following would not be

Q11: Studies have shown that 50-70% of the

Q12: Under the assumption of clean surplus accounting,how

Q21: Operating income is negative in an amount

Q26: Upton Company has consistently used the percentage-of-

Q34: Which is the date when employees elect

Q52: Differences between income before taxes and taxable

Q52: The value of a share of common

Q55: When an analyst uses measures of past