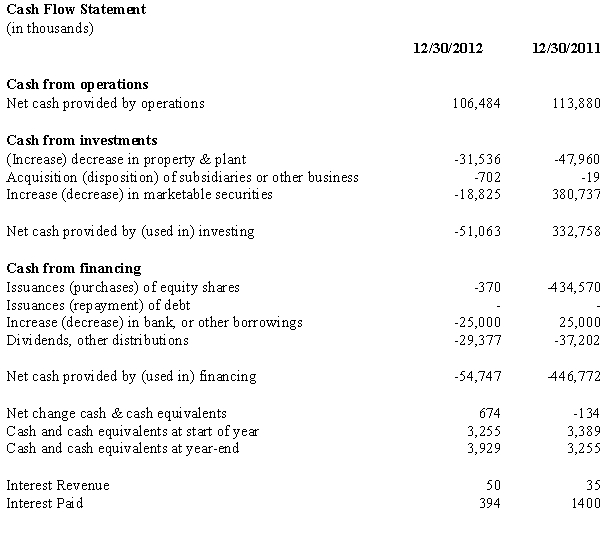

Below is information from the statement of cash flow and income statement for Garland Products,Inc.for 2012 and 2011.Marketable securities represent investments of excess cash that Garland Products does not need for operations.Garland Products' tax rate is 35%.  Using the above information calculate the amount of free cash flows to all debt and equity capital stakeholders for Garland Products for year 2012 and 2011.

Using the above information calculate the amount of free cash flows to all debt and equity capital stakeholders for Garland Products for year 2012 and 2011.

Definitions:

Par Value

The face value of a bond or a stock's stated value, as set forth in the corporate charter.

Yield To Maturity

The total return anticipated on a bond if it is held until the maturity date, considering all interest payments at set intervals and the principal repayment at maturity.

Intrinsic Value

The actual, inherent worth of an asset or company, not necessarily matching its current market value.

Zero-Coupon Bond

A debt security that does not pay interest but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full face value.

Q6: Under the value-to-book model new projects will

Q7: When a foreign entity has the U.S.dollar

Q14: The formula for forecasting inventory is _

Q29: All of the following are events that

Q37: Projected financial statements can be used to

Q41: Net income for the year for Tanglewood

Q41: A key characteristic of asset measurement is

Q43: The use of P/E ratios in valuation

Q57: All of the following typically drive firm-specific

Q65: Most publicly traded firms in the United