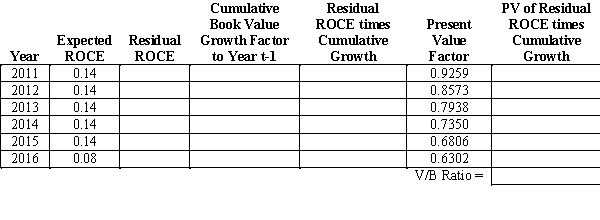

Assume an analyst is evaluating a firm with $1,000 of book value of common equity and a cost of equity capital equal to 8 percent.Assume that the analyst forecasts that the firm will earn ROCE of 14 percent until year 2016,when the firm will start earning ROCE equal to 8 percent.The company pays no dividends and will not engage in any stock transactions.Use this information to complete the following table and calculate the firm's value-to-book ratio.

Definitions:

Jawless Fish

A group of vertebrates known for lacking jaws, including lampreys and hagfish, representing the earliest fish in the evolutionary history.

Bones

The rigid organs that constitute part of the endoskeleton of vertebrates, providing support and protection and enabling movement.

Fins

External appendages on fishes and some other aquatic animals, used primarily for movement, steering, and balance in water.

Jawless Fish

Primitive vertebrates lacking jaws, such as lampreys and hagfish, forming the class Agnatha.

Q4: Assume that Hsu Company needs to acquire

Q8: When input prices are increasing,companies that use

Q10: Income tax expense consists of two components,the

Q26: If the market price of a share

Q34: The authors set forth a seven-step forecasting

Q39: A LIFO liquidation during periods when prices

Q40: Residual income in a long-run steady-state growth

Q41: Net income for the year for Tanglewood

Q45: Firms recognize a(n)_ when the carrying amount

Q57: Economists sometimes argue that earnings are not