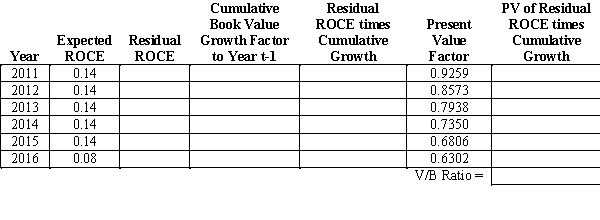

Assume an analyst is evaluating a firm with $1,000 of book value of common equity and a cost of equity capital equal to 8 percent.Assume that the analyst forecasts that the firm will earn ROCE of 14 percent until year 2016,when the firm will start earning ROCE equal to 8 percent.The company pays no dividends and will not engage in any stock transactions.Use this information to complete the following table and calculate the firm's value-to-book ratio.

Definitions:

Q1: All of the following are logical steps

Q3: The theoretical PE model does not work

Q18: To determine the appropriate weights to use

Q20: Investors have invested $25,000 in common equity

Q21: In the value-to-book model growth adds value

Q35: Assume a zero-growth rate for earnings and

Q43: Given the information provided about Card Sharks,what

Q51: Although LIFO generally provides higher quality earnings

Q51: Free cash flow is calculated as net

Q61: A contractor would not use _ method