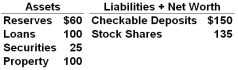

Answer the question based on the following consolidated balance sheet for the commercial banking system. Assume the required reserve ratio is 12 percent. All figures are in billions of dollars:  Refer to the above data. If the commercial banking system actually loans out the maximum amount it is able to lend, excess reserves will fall:

Refer to the above data. If the commercial banking system actually loans out the maximum amount it is able to lend, excess reserves will fall:

Definitions:

Negotiable Instrument

An official paper that obligates the payment of a fixed money amount, which can be demanded at any time or paid at a specific interval, with the document listing the responsible payer's name.

Words of Negotiability

Specific legal phrases or terms used in a financial instrument that indicate its transferability or negotiability.

Bearer Instrument

A negotiable financial instrument that entitles the holder or bearer to the rights stated on the document.

Truth-in-Savings Act

A U.S. federal law designed to promote the disclosure of account terms and fees to consumers, particularly regarding savings accounts and interest-earning bank accounts.

Q8: The aggregate demand curve or schedule shows

Q13: The labels for the axes of the

Q20: A commercial bank has actual reserves of

Q28: The cyclically-adjusted surplus as a percentage of

Q50: A bank can get additional excess reserves

Q72: When the excess capacity of business expands

Q81: As of 2012, more than half of

Q83: Which of the following statements is correct?<br>A)

Q134: Diversification is an investment strategy that seeks

Q147: If you are told that the government