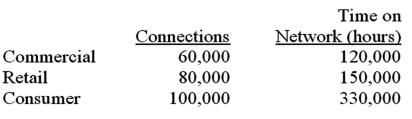

Fenway Telcom has three divisions,commercial,retail,and consumer,that share the common costs of the company's computer server network.The annual common costs are $2,400,000.You have been provided with the following information for the upcoming year:  The cost accountant determined $1,700,000 of the server network's costs were fixed and should be allocated based on the number of connections.The remaining costs should be allocated based on the time on the network.What is total server network costs allocated to the Retail Division,assuming the company uses dual-rates to allocate common costs?

The cost accountant determined $1,700,000 of the server network's costs were fixed and should be allocated based on the number of connections.The remaining costs should be allocated based on the time on the network.What is total server network costs allocated to the Retail Division,assuming the company uses dual-rates to allocate common costs?

Definitions:

Direct Materials

Raw materials that are directly traceable to the production of a specific good or service.

Direct Labor

The wages and benefits for employees directly involved in the production of goods or services.

Plantwide Factory Overhead Rate

A single overhead absorption rate used across an entire manufacturing plant, calculated by dividing the total factory overhead by a predetermined base, such as total direct labor hours or machine hours.

Overhead Costs

Expenses not directly associated with production, including rent, utilities, and office expenses, that support the overall business operations.

Q3: Which of the following types of accounts

Q25: Given the following data for Division M:

Q28: Which of the following subunits is most

Q37: Given the following information for Division K:

Q40: Kimbeth Manufacturing uses process costing to control

Q54: Data on Goodman Company's direct-labor costs are

Q66: The following information is available for Company

Q66: An operating unit of an organization is

Q69: A standard cost system may be used

Q83: The Emery Construction Company occupies 85,000 square