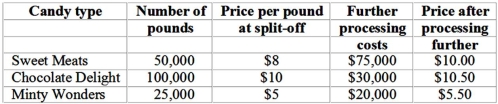

Great Sweets Candy Company produces various types of candies.Several candies could be sold at the split-off point or processed further and sold in a different form after further processing.The candies are produced in a joint processing operation with $500,000 of joint processing costs monthly,which are allocated based on pounds produced.Information concerning this process for a recent month appears below:  The net advantage (disadvantage) of processing Sweet Meats further is:

The net advantage (disadvantage) of processing Sweet Meats further is:

Definitions:

Investment

The act of allocating resources, usually money, in the expectation of generating an income or profit.

Compounded Annually

Interest on an investment or loan calculated once a year, where the interest is added to the principal.

9-Year

An undefined term likely referring to a period or duration of nine years.

Compounded Quarterly

This refers to the process where interest is calculated and added to the principal sum of an investment or loan on a quarterly basis.

Q13: Which of the following responsibility centers is

Q17: The journal entry to write-off a significant

Q21: Budgeted production needs are determined by:<br>A)adding budgeted

Q22: External failure activities:<br>A)seek to prevent defects in

Q31: Smelly Perfume Company manufactures and distributes several

Q37: Activity-based costing (ABC)is a two-stage cost allocation

Q39: Using direct labor costs to allocate overhead

Q49: Which of the following statements is (are)false

Q66: Given the following data for Division X:

Q83: RS Company manufactures and distributes two products,R