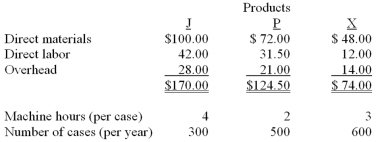

Smelly Perfume Company manufactures and distributes several different products.The company currently uses a plantwide allocation method for allocating overhead at a rate of $7 per direct labor hour.Cindy is the department manager of Department C which produces Products J and P.Department C has $16,200 in traceable overhead.Diane is the department manager of Department D which manufactures Product X.Department D has $11,100 in traceable overhead.The product costs (per case of 24 bottles) and other information are as follows:  Department D has recently purchased and installed new computerized equipment for Product X.This equipment will increase the overhead costs by $2,700 and decrease labor costs (due to time savings) in Department D by $3.00 per case.Machine hours will not change.If Smelly uses a plantwide rate based on direct labor hours,what is the revised product cost per case for Product X?

Department D has recently purchased and installed new computerized equipment for Product X.This equipment will increase the overhead costs by $2,700 and decrease labor costs (due to time savings) in Department D by $3.00 per case.Machine hours will not change.If Smelly uses a plantwide rate based on direct labor hours,what is the revised product cost per case for Product X?

Definitions:

Financial Stability

The condition of having strong financial health and resilience, often characterized by sufficient liquidity, capital, and risk management capabilities.

Developing Close Relationships

The process of building strong, beneficial partnerships based on trust, commitment, and communication, often in a professional or business context.

Communicating Effectively

The ability to convey information and ideas in a clear, concise, and meaningful way to ensure mutual understanding.

Business Reviews

Formal evaluations of a company's performance, typically involving analysis of financial statements, operational effectiveness, and market positioning.

Q14: The forecasting method in which individual forecasts

Q17: The journal entry to write-off a significant

Q21: There is no single accounting measure that

Q33: Scottso Enterprises has identified the following overhead

Q56: Which of the following budgets is not

Q63: Harry Dishman owns and operates Harry's Septic

Q69: The following events took place at a

Q79: Which of the following statements concerning a

Q86: Fab Co.manufactures textiles.Among Fab's 2012 manufacturing costs

Q105: The difference between the resources used and