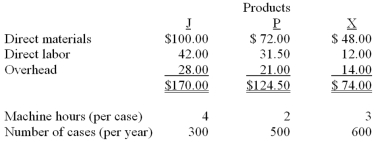

Smelly Perfume Company manufactures and distributes several different products.The company currently uses a plantwide allocation method for allocating overhead at a rate of $7 per direct labor hour.Cindy is the department manager of Department C which produces Products J and P.Department C has $16,200 in traceable overhead.Diane is the department manager of Department D which manufactures Product X.Department D has $11,100 in traceable overhead.The product costs (per case of 24 bottles) and other information are as follows:  Department D has recently purchased and installed new computerized equipment for Product X.This equipment will increase the overhead costs by $2,700 and decrease labor costs (due to time savings) in Department D by $3.00 per case.Machine hours will not change.If Smelly uses departmental rates,what are the product costs per case for Product X assuming Departments C and D use direct labor hours and machine hours as their respective allocation bases?

Department D has recently purchased and installed new computerized equipment for Product X.This equipment will increase the overhead costs by $2,700 and decrease labor costs (due to time savings) in Department D by $3.00 per case.Machine hours will not change.If Smelly uses departmental rates,what are the product costs per case for Product X assuming Departments C and D use direct labor hours and machine hours as their respective allocation bases?

Definitions:

Four-Month Note

A promissory note or financial instrument that matures or comes due in four months.

Interest Calculation

The process of determining the interest charge on a loan or financial holding, based on the principal, rate, and period.

Time Expression

Phrases or terms used to indicate a specific period during which an event occurs or is scheduled to take place.

Maturity Dates

The specific dates on which a financial instrument such as a bond, loan, or fixed income instrument becomes due and is to be paid off.

Q6: The basic concepts involved in activity-based costing

Q19: Hawkins Products,Inc. ,has found that new products

Q28: The debits to Work-in-Process for Department #2

Q30: Which of the following statements does not

Q30: The least complex segment or area of

Q49: Which of the following statements is (are)false

Q52: The manufacturing overhead budget requires that costs

Q64: A company has identified the following overhead

Q76: ....

Q91: Rogers Company is preparing its annual profit