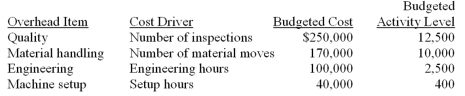

Scottso Enterprises has identified the following overhead costs and cost drivers for the coming year:  Budgeted direct labor cost was $200,000 and budgeted direct material cost was $800,000.The following information was collected on three jobs that were completed during the month:

Budgeted direct labor cost was $200,000 and budgeted direct material cost was $800,000.The following information was collected on three jobs that were completed during the month:  The company prices its products at 150% of cost.If the company uses activity-based costing (ABC) ,the price of each unit of Job B-32 would be:

The company prices its products at 150% of cost.If the company uses activity-based costing (ABC) ,the price of each unit of Job B-32 would be:

Definitions:

Cost of Capital

The rate of return a company must earn on its investment projects to maintain its market value and attract funds.

Net Present Value

A financial metric indicating the value of a series of cash flows over time in today's dollars.

Capital Budgeting

The process a business undertakes to evaluate potential major investments or expenditures to ensure financial viability and return on investment.

Tax Haven

A country or jurisdiction with very low or no taxes, often used by businesses and wealthy individuals to reduce their tax liability.

Q13: Smelly Perfume Company manufactures and distributes several

Q20: The Business School at Eastern College is

Q36: The opportunity cost of making a component

Q52: The journal entry to record requisitions of

Q59: The Transfers In (TI)costs in the basic

Q63: The Document Creation Center (DCC)for Alegis Corp.provides

Q65: The Document Creation Center (DCC)for Alegis Corp.provides

Q79: Harry Dishman owns and operates Harry's Septic

Q83: Red Company had Work-in-Process Inventories that were

Q85: In the computation of the manufacturing cost