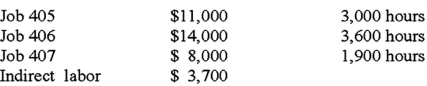

The following selected data were taken from the books of the Bixby Box Company.The company uses job costing to account for manufacturing costs.The data relate to June operations.A) Materials and supplies were requisitioned from the stores clerk as follows: Job 405,material X,$7,000.Job 406,material X,$3,000;material Y,$6,000.Job 407,material X,$7,000;material Y,$3,200.For general factory use: materials A,B,and C,$2,300.B) Time tickets for the month were chargeable as follows:  C) Other information:

C) Other information:

Factory paychecks for $36,700 were issued during the month.Various factory overhead charges of $19,400 were incurred on account.Depreciation of factory equipment for the month was $5,400.Factory overhead was applied to jobs at the rate of $3.50 per direct labor hour.Job orders completed during the month: Job 405 and Job 406.Selling and administrative costs were $2,100.Factory overhead is closed out only at the end of the year.The balance in the factory overhead account would represent the fact that overhead was:

Definitions:

Cost Driver

A factor that causes a change in the cost of an activity, directly affecting the cost of production or operations.

Cost Pool

A grouping of individual costs typically by department or service, from which cost allocations are made to products or services.

Cost Allocation

The process of assigning indirect costs to different departments, projects, or production processes within a company to ensure accurate product costing or project budgeting.

Reciprocal Services Method

An accounting method used to allocate costs in situations where support departments provide services to each other as well as to production departments.

Q11: Makwa Industries has developed two new products

Q25: The Business School at Eastern College is

Q36: The opportunity cost of making a component

Q45: The range within which fixed costs remain

Q59: Dumping occurs when a company exports its

Q69: Smelly Perfume Company manufactures and distributes several

Q73: The estimated unit costs for a company

Q76: The department cost allocation method provides more

Q86: The journal entry to record the completion

Q91: Which of the following items would not