The difference between the variable ending inventory cost and the absorption ending inventory cost is:

The difference between the variable ending inventory cost and the absorption ending inventory cost is:

Definitions:

Consignee

The individual or entity to whom goods are shipped and who is responsible for receiving the shipment and completing any customs paperwork.

Ending Inventory

The value of goods that remain unsold at the end of an accounting period.

Cost Flow Assumption

An accounting method used to value inventory and determine the cost of goods sold, such as FIFO (First In, First Out) or LIFO (Last In, First Out).

LIFO

"Last In, First Out" method of inventory valuation where the most recently produced items are recorded as sold first.

Q28: A cost allocation rule is the method

Q38: Which of the following statements is (are)false

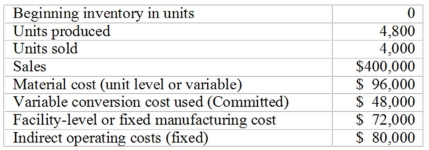

Q42: You have been provided with the following

Q47: The Armer Company is accumulating data to

Q50: The full cost fallacy occurs when a

Q58: Which of the following is not a

Q59: In the standard regression equation of y

Q68: You have been provided with the following

Q78: Which of the following is not an

Q92: The delivery of products or services to