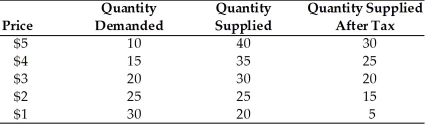

-An excise tax is a tax that is levied on

Definitions:

Value of Human Life

An economic value assigned to a human life based on factors like income potential, costs, and benefits in a given context, often used in public policy and insurance.

Value of Human Life

The economic or ethical worth assigned to a human life, used in legal and policy-making decisions to assess the cost versus benefits of actions that could impact human mortality.

Voluntary Risks

Risks that individuals knowingly and willingly expose themselves to in pursuit of a benefit or for personal reasons.

Excludable

A characteristic of a good where its use can be restricted to only those who pay for it.

Q41: When the automobile replaced the horse as

Q58: The natural rate of unemployment is the

Q75: The demand and supply of a product

Q114: All of the following are possible funding

Q131: A major criticism of static tax analysis

Q152: The economy is undergoing a recession that

Q163: All of the following are signals of

Q172: Over the long run, a government's fundamental

Q187: What is one result of the Medicare

Q269: What type of policy does the government