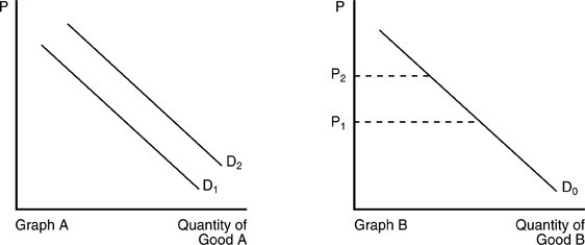

-In the above figure, the demand curve for Good A shifts from D1 to D2 in Graph A when the price of Good B changes from P1 to P2 in Graph B. We can conclude that

Definitions:

Self-Employment Tax

Self-Employment Tax is a tax consisting of Social Security and Medicare taxes primarily for individuals who work for themselves.

Self-Employment Income

Earnings derived from one's own business, professional practice, or freelance work, subject to tax and self-employment contributions.

Adjusted Basis

The value of an asset for tax purposes, calculated by modifying its original cost by factors such as depreciation or improvements.

Accumulated Depreciation

The total depreciation expense charged against an asset over its useful life.

Q10: According to the text, the highest 20

Q35: A fundamental principle in demand analysis is

Q42: Suppose a union negotiates for its members

Q63: All of the following are income in

Q224: If the government imposes a per-unit tax

Q251: The official number of poor in the

Q322: According to the above figure, the equilibrium

Q358: The law of demand states that<br>A) consumers

Q367: The price that we observe in the

Q401: Two goods are substitutes when<br>A) an increase