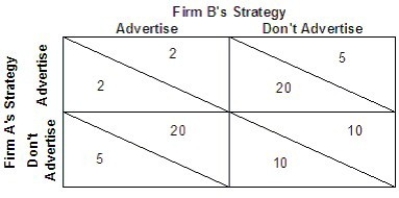

Refer to the above payoff matrix for the profits (in $ millions) of two firms (A and B) making a decision to advertise or not. Which of the following is the outcome of the dominant strategy without cooperation?

Refer to the above payoff matrix for the profits (in $ millions) of two firms (A and B) making a decision to advertise or not. Which of the following is the outcome of the dominant strategy without cooperation?

Definitions:

Deferred Tax Liabilities

Future tax payments due to temporary differences between financial accounting and tax accounting practices.

Deferred Tax Assets

Assets on a company's balance sheet that may be used to reduce future tax liability resulting from temporary timing differences between accounting and tax treatments.

Current Tax Liabilities

Taxes owed to the government within the current fiscal year.

Temporary Difference

Refers to the differences that arise between the tax base of an asset or liability and its carrying amount in the financial statements, which will result in taxable or deductible amounts in future years.

Q30: This agency regulates workplace safety and health

Q52: The argument that suggests that regulators balance

Q79: Which of the following is an example

Q118: One of the agencies responsible for enforcement

Q144: In the long run, equilibrium positions that

Q220: A firm that has taken advantage of

Q222: In the short run, a monopolistically competitive

Q245: Discuss the Clayton Act and the Federal

Q250: Typically a mix of informational and persuasive

Q280: Over the past several decades, U.S. firms