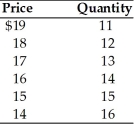

-Given the data in the above table, what is the marginal revenue when the 15th unit is sold?

Definitions:

American Opportunity Tax Credit

A credit for qualified education expenses paid for an eligible student for the first four years of higher education, with the potential to receive a partial refund if the credit is more than the taxpayer owes.

Lifetime Learning Credit

A tax credit available in the United States for qualified tuition and related expenses paid for eligible students enrolled in an eligible educational institution, aiming to promote post-secondary education.

Tax Advantage

Financial benefits and savings provided through exemptions, deductions, and credits that reduce the amount of tax owed.

Earned Income Credit

A refundable tax credit for low to moderate-income working individuals and families, aimed at decreasing the amount of tax owed and potentially returning money to the taxpayer.

Q25: All of the following are characteristics of

Q99: Economic inefficiency exists when<br>A) P = MR.<br>B)

Q131: Perfect competition is characterized by<br>A) many buyers

Q221: All of Jill's friends have been telling

Q231: Why is price less than marginal revenue

Q263: What is always TRUE about the short-run

Q281: Informational advertising is mostly used for<br>A) an

Q283: Some electrical utilities are monopolies because of<br>A)

Q287: The firm in the above figure breaks

Q344: When grocery stores issue special discount membership