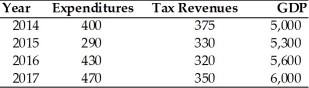

-Suppose that initially there is no public debt. Using the above table, the public debt over this four-year period would have

Definitions:

Direct Taxes

Taxes that are levied directly on the income or wealth of an individual or organization, such as income tax and property tax.

Per Capita Real GDP

This is a measure of the average economic output per person, adjusted for inflation, in a specific area.

GDP Deflator

A measure for evaluating the price index of all fresh, domestically produced, final goods and services in an economy.

Population

The total number of people inhabiting a particular territory or geographic area.

Q5: As a possible approach to eliminating the

Q69: According to the above table, the value

Q140: If the crowding-out effect is complete and

Q156: Supply-side economists argue that decreasing marginal tax

Q157: Which of the following is a financial

Q223: The Fed<br>A) is responsible for minting coins.<br>B)

Q266: In the traditional Keynesian model, an increase

Q281: Following a new deposit of $100 at

Q318: Which of the following is NOT an

Q383: The purchasing power of money<br>A) is determined