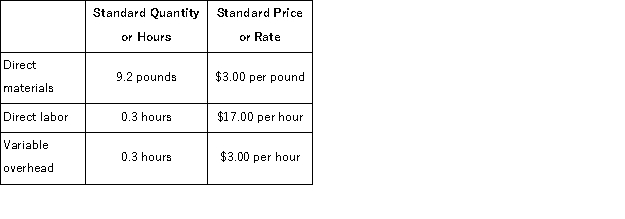

Berends Corporation makes a product with the following standard costs:  The company reported the following results concerning this product in April.

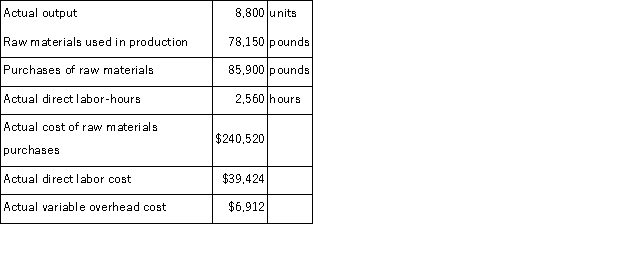

The company reported the following results concerning this product in April.  The company applies variable overhead on the basis of direct labor-hours.The direct materials purchases variance is computed when the materials are purchased. The variable overhead rate variance for April is:

The company applies variable overhead on the basis of direct labor-hours.The direct materials purchases variance is computed when the materials are purchased. The variable overhead rate variance for April is:

Definitions:

Synergistic Benefits

The additional value created by combining two or more elements (companies, technologies, assets) that when integrated, produce a total effect greater than the sum of their individual effects.

Net Present Value

Net Present Value (NPV) is a financial metric that calculates the difference between the present value of cash inflows and outflows over a period of time, used in capital budgeting to assess the profitability of an investment or project.

After-Tax Net Present Value

A financial calculation that evaluates the profitability of an investment or project after accounting for taxes, presenting the difference between the present value of cash inflows and outflows.

Depreciation

The distribution of a physical asset's cost across its lifespan, mirroring its depreciation over time.

Q2: Bracken Corporation is a small wholesaler of

Q4: Which of the following actions by the

Q6: An important family intervention to facilitate family

Q39: "If event X occurs then event Y

Q83: Contribution income statements are used to measure

Q97: Tetrault Jeep Tours operates jeep tours in

Q115: Ortman Corporation makes a product with the

Q143: Blaster, Inc. , manufactures portable radios.Each radio

Q175: Dus Catering uses two measures of activity,

Q287: Federick Clinic uses client-visits as its measure