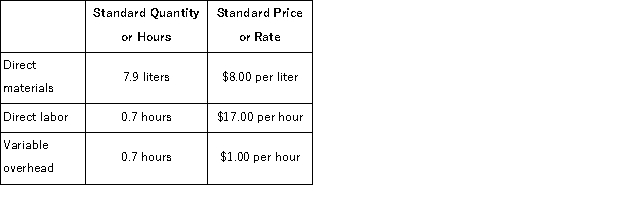

Ortman Corporation makes a product with the following standard costs:  The company reported the following results concerning this product in May.

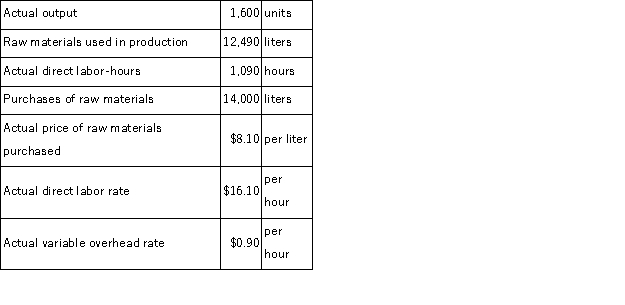

The company reported the following results concerning this product in May.  The company applies variable overhead on the basis of direct labor-hours.The direct materials purchases variance is computed when the materials are purchased. The variable overhead efficiency variance for May is:

The company applies variable overhead on the basis of direct labor-hours.The direct materials purchases variance is computed when the materials are purchased. The variable overhead efficiency variance for May is:

Definitions:

Federal Income Tax

A tax levied by the United States federal government on the annual earnings of individuals, corporations, trusts, and other legal entities.

Trade Fixtures

Articles of personal property that have been annexed to real property leased by a tenant during the term of the lease and that are necessary to the carrying on of a trade.

Substantial Damage

Significant physical harm or damage to a property or structure, often affecting its value, usability, or function.

Lease Term

The duration for which a lease agreement is valid, typically specifying start and end dates.

Q7: Dilbert Farm Supply is located in a

Q36: Seventy percent of Parlee Corporation's sales are

Q46: Morie Corporation is working on its direct

Q48: The direct materials budget is typically prepared

Q77: Eacher Wares is a division of a

Q88: Which of the following comparisons best isolates

Q102: Hey Clinic bases its budgets on patient-visits.During

Q113: The Collins Corporation uses standard costing and

Q134: Richards Corporation has the following budgeted sales

Q202: Buonocore Clinic uses client-visits as its measure