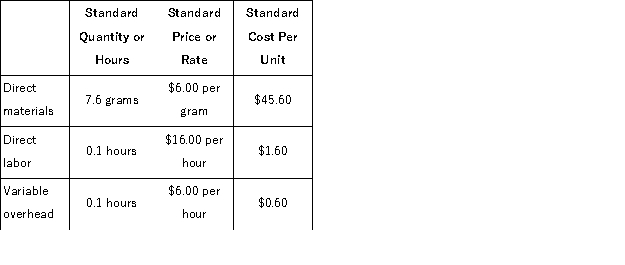

Gilder Corporation makes a product with the following standard costs:  The company reported the following results concerning this product in June.

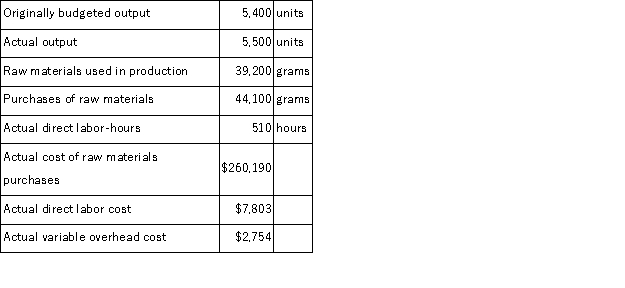

The company reported the following results concerning this product in June.  The company applies variable overhead on the basis of direct labor-hours.The direct materials purchases variance is computed when the materials are purchased. The materials quantity variance for June is:

The company applies variable overhead on the basis of direct labor-hours.The direct materials purchases variance is computed when the materials are purchased. The materials quantity variance for June is:

Definitions:

Activity-Based Costing

An accounting method that assigns costs to products or services based on the activities and resources that go into producing them.

Overapplied

A situation where the allocated costs exceed the actual costs incurred.

Underapplied

Refers to a situation where the allocated costs are less than the actual costs incurred.

Factory Overhead

The indirect costs of manufacturing, such as salaries of quality control personnel and depreciation of factory equipment.

Q8: _ is established as individual members find

Q17: Tammo Jeep Tours operates jeep tours in

Q32: Financial data for Redstone Company for last

Q35: Tout Corporation makes a product that has

Q73: The following information was taken from the

Q85: During January, Desousa Clinic plans for an

Q97: A continuous or perpetual budget is a

Q107: Last year a company had sales of

Q138: The following labor standards have been established

Q225: Federick Clinic uses client-visits as its measure