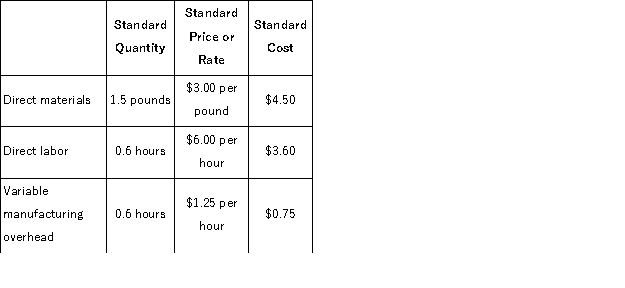

Pardoe, Inc. , manufactures a single product in which variable manufacturing overhead is assigned on the basis of standard direct labor-hours.The company uses a standard cost system and has established the following standards for one unit of product:  During March, the following activity was recorded by the company: • The company produced 3, 000 units during the month.

During March, the following activity was recorded by the company: • The company produced 3, 000 units during the month.

• A total of 8, 000 pounds of material were purchased at a cost of $23, 000.

• There was no beginning inventory of materials on hand to start the month;at the end of the month, 2, 000 pounds of material remained in the warehouse.

• During March, 1, 600 direct labor-hours were worked at a rate of $6.50 per hour.

• Variable manufacturing overhead costs during March totaled $1, 800.

The direct materials purchases variance is computed when the materials are purchased.

The materials quantity variance for March is:

Definitions:

Variable Cost

Costs that vary directly with the level of production or with the volume of output.

Fixed Cost

Expenses that do not change with the level of production or sales volume, such as rent, salaries, and insurance premiums.

Contribution Margin Technique

A method used to evaluate how sales affect net income or profits, calculated as sales revenue minus variable costs.

Net Income (Loss)

The total profit or loss a company generates in a specific period after all expenses, taxes, and costs have been deducted from total revenue.

Q4: The family development realm of assessment within

Q37: Given a linear curve, the value on

Q40: Gandrud Kennel uses tenant-days as its measure

Q48: Daab Products is a division of a

Q70: Sund Corporation bases its budgets on the

Q75: Longview Hospital performs blood tests in its

Q91: Noel Enterprises has budgeted sales in units

Q153: Noel Enterprises has budgeted sales in units

Q171: The sales budget often includes a schedule

Q229: Spirer Corporation manufactures and sells a single