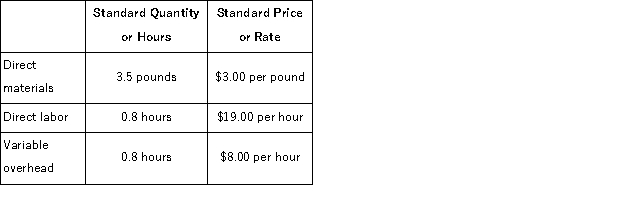

Epley Corporation makes a product with the following standard costs:  In July the company produced 3, 300 units using 12, 240 pounds of the direct material and 2, 760 direct labor-hours.During the month, the company purchased 13, 000 pounds of the direct material at a cost of $35, 100.The actual direct labor cost was $51, 612 and the actual variable overhead cost was $20, 148. The company applies variable overhead on the basis of direct labor-hours.The direct materials purchases variance is computed when the materials are purchased.

In July the company produced 3, 300 units using 12, 240 pounds of the direct material and 2, 760 direct labor-hours.During the month, the company purchased 13, 000 pounds of the direct material at a cost of $35, 100.The actual direct labor cost was $51, 612 and the actual variable overhead cost was $20, 148. The company applies variable overhead on the basis of direct labor-hours.The direct materials purchases variance is computed when the materials are purchased.

The materials quantity variance for July is:

Definitions:

Times Interest Earned Ratio

A metric that measures a company's ability to meet its debt obligations by comparing income before interest and taxes to interest expenses.

Net Income

The total profit of a company after all expenses and taxes have been deducted from total revenue, representing the company's bottom line.

Contingent Liabilities

Contingent liabilities are potential liabilities that may arise depending on the outcome of a future event.

Natural Disasters

Severe and sudden natural events caused by environmental factors that can result in substantial damage and pose significant risks to life, property, and economic stability.

Q7: Throughout the trajectory of a chronic illness,

Q34: Biery Corporation makes a product with the

Q62: Baad Industries is a division of a

Q92: LFM Corporation makes and sells a product

Q176: Hoppy Corporation compares monthly operating results to

Q181: Epley Corporation makes a product with the

Q246: Juenemann Kennel uses tenant-days as its measure

Q256: Jiminian Clinic uses client-visits as its measure

Q287: Federick Clinic uses client-visits as its measure

Q294: Smithj Kennel uses tenant-days as its measure