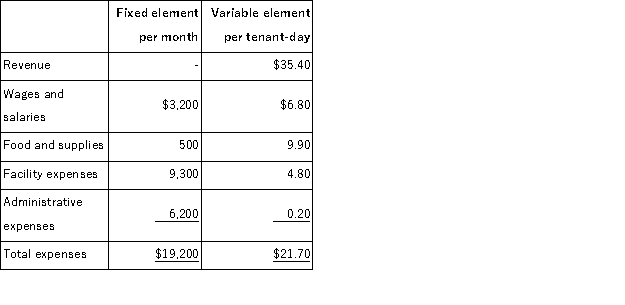

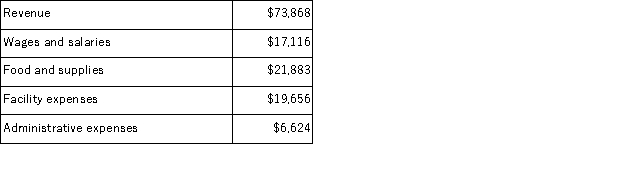

Ordway Kennel uses tenant-days as its measure of activity;an animal housed in the kennel for one day is counted as one tenant-day.During June, the kennel budgeted for 2, 100 tenant-days, but its actual level of activity was 2, 070 tenant-days.The kennel has provided the following data concerning the formulas used in its budgeting and its actual results for June: Data used in budgeting:  Actual results for June:

Actual results for June:  The wages and salaries in the planning budget for June would be closest to:

The wages and salaries in the planning budget for June would be closest to:

Definitions:

Cash Dividend

A payment made by a corporation to its shareholders, usually as a distribution of profits.

Indirect Method

A cash flow statement presentation technique where net income is adjusted for changes in balance sheet accounts to calculate operating cash flow.

Indirect Method

A technique used in cash flow statement preparation where net income is adjusted for non-cash transactions to calculate operating cash flows.

Cash Dividends

Payments made by a corporation to its shareholder members from earnings, typically in the form of cash.

Q5: Identify nursing actions that relates to three

Q17: Iba Industries is a division of a

Q24: When considering a number of investment projects,

Q49: The following are budgeted data for the

Q53: (Ignore income taxes in this problem. )Frick

Q56: Linscott Corporation manufactures and sells a single

Q75: Queue time is considered value-added time.

Q82: Ros Corporation's flexible budget cost formula for

Q108: Chabot Company had the following results last

Q110: Rehmer Corporation is working on its direct