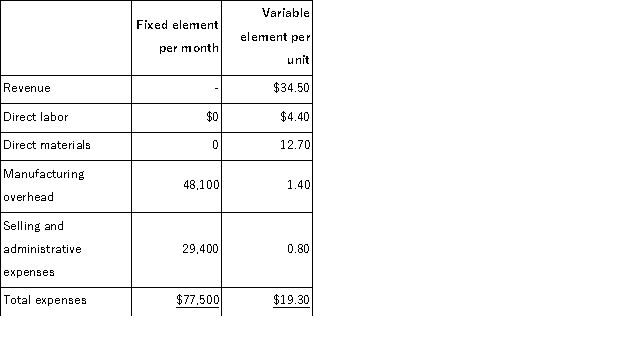

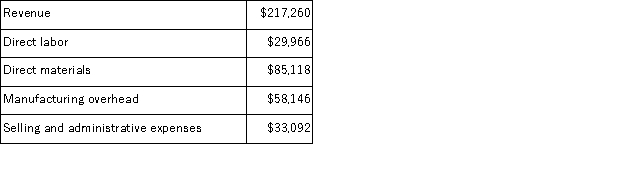

Tabeling Corporation manufactures and sells a single product.The company uses units as the measure of activity in its budgets and performance reports.During August, the company budgeted for 6, 500 units, but its actual level of activity was 6, 540 units.The company has provided the following data concerning the formulas used in its budgeting and its actual results for August: Data used in budgeting:  Actual results for August:

Actual results for August:  The activity variance for net operating income in August would be closest to:

The activity variance for net operating income in August would be closest to:

Definitions:

Factory Overhead

Indirect costs incurred during the manufacturing process, such as utilities, maintenance, and salaries, that are not directly tied to production.

Direct Labor Costs

Wages and benefits paid to employees who are directly involved in the production of goods or services.

Indirect Costs

Expenses not directly tied to the production of goods or services, such as overhead, rent, and administrative salaries.

Manufacturing Environment

A setting where goods are produced on a large scale using machinery, labor, and other resources.

Q16: The LFG Corporation makes and sells a

Q88: The Prattle Corporation makes and sells only

Q104: The following are budgeted data: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2487/.jpg"

Q122: The investment required for the project profitability

Q154: Rhett Corporation manufactures and sells dress shirts.Each

Q155: Caprice Corporation is a wholesaler of industrial

Q163: Which of the following benefits could an

Q163: Dul Corporation has provided the following data

Q272: Fortmann Kennel uses tenant-days as its measure

Q276: Hatzenbuhler Manufacturing Corporation has prepared the following