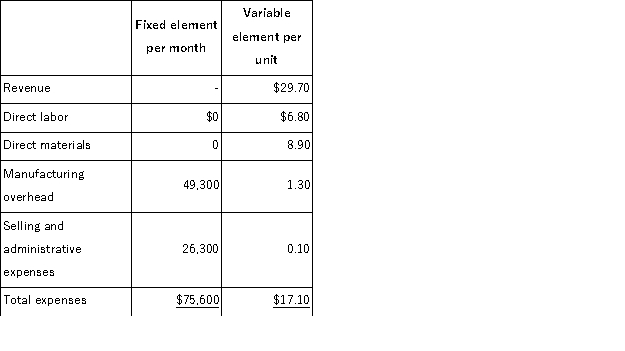

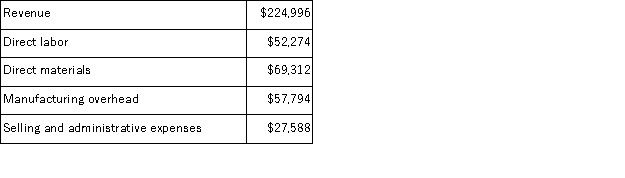

Coderre Corporation manufactures and sells a single product.The company uses units as the measure of activity in its budgets and performance reports.During July, the company budgeted for 7, 800 units, but its actual level of activity was 7, 780 units.The company has provided the following data concerning the formulas used in its budgeting and its actual results for July: Data used in budgeting:  Actual results for July:

Actual results for July:  The activity variance for direct labor in July would be closest to:

The activity variance for direct labor in July would be closest to:

Definitions:

Adjusted Cost

The cost of an asset after accounting for adjustments such as depreciation, improvements, or damage.

Estimated Manufacturing Overhead

Projected costs that a company expects to incur for manufacturing overhead, excluding direct labor and materials.

Applied Overhead

The portion of overhead costs allocated to specific products or cost objects based on the predetermined overhead rate.

Actual Manufacturing Overhead

Refers to the actual incurred costs that are indirectly associated with the manufacturing of a product, including costs like utilities and maintenance for manufacturing facilities.

Q11: The following data for March have been

Q89: Wesolick Clinic uses client-visits as its measure

Q98: Czlapinski Corporation is considering a capital budgeting

Q100: Emerich Corporation keeps careful track of the

Q100: Oddo Corporation makes a product with the

Q107: Krizum Industries makes heavy construction equipment.The standard

Q109: The following data have been provided by

Q127: The following data have been provided by

Q145: In a make-or-buy decision, relevant costs include:<br>A)unavoidable

Q249: Larance Detailing's cost formula for its materials