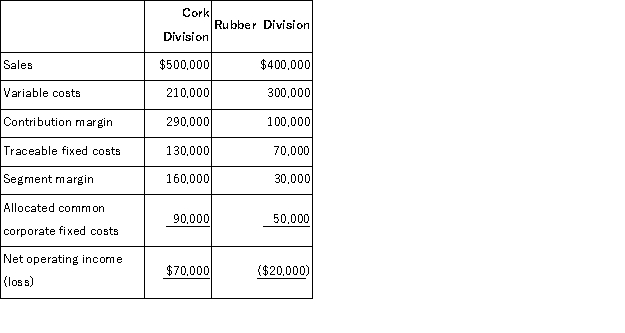

Vanikord Corporation currently has two divisions which had the following operating results for last year:  Because the Rubber Division sustained a loss, the president of Vanikoro is considering the elimination of this division.All of the division's traceable fixed costs could be avoided if the division was dropped.None of the allocated common corporate fixed costs could be avoided.If the Rubber Division was dropped at the beginning of last year, how much higher or lower would Vanikoro's total net operating income have been for the year?

Because the Rubber Division sustained a loss, the president of Vanikoro is considering the elimination of this division.All of the division's traceable fixed costs could be avoided if the division was dropped.None of the allocated common corporate fixed costs could be avoided.If the Rubber Division was dropped at the beginning of last year, how much higher or lower would Vanikoro's total net operating income have been for the year?

Definitions:

Stepfamilies

Family units formed through remarriage, involving a parent, a stepparent, and the children from previous relationships.

Compadrazgo

A cultural practice common in Latin America that establishes strong, ceremonial ties between parents and their child's godparents.

Godmother

A woman who is chosen by the parents to take an interest in a child's upbringing and personal development, and to act as a sponsor at the child's baptism.

African American Women

Women of African descent living in the United States, who have a unique cultural, social, and historical position shaped by factors such as race, gender, and class.

Q3: Ginger Corporation uses an activity-based costing system

Q29: Roddey Corporation is a specialty component manufacturer

Q39: Dowchow Corporation makes two products from a

Q74: Trumbull Corporation budgeted sales on account of

Q74: Gearhart Corporation bases its budgets on the

Q80: In activity-based costing, some manufacturing costs can

Q157: Smithj Kennel uses tenant-days as its measure

Q214: Wragg Urban Diner is a charity supported

Q219: Criblez Corporation has two divisions: Blue Division

Q299: Hagel Clinic uses client-visits as its measure