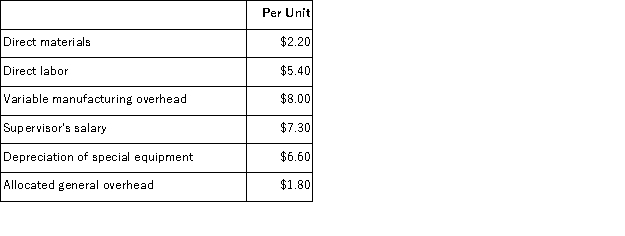

Ramon Corporation makes 18, 000 units of part E44 each year.This part is used in one of the company's products.The company's Accounting Department reports the following costs of producing the part at this level of activity:  An outside supplier has offered to make and sell the part to the company for $23.30 each.If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company.If the outside supplier's offer were accepted, only $5, 000 of these allocated general overhead costs would be avoided.In addition, the space used to produce part E44 would be used to make more of one of the company's other products, generating an additional segment margin of $21, 000 per year for that product. What would be the impact on the company's overall net operating income of buying part E44 from the outside supplier?

An outside supplier has offered to make and sell the part to the company for $23.30 each.If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company.If the outside supplier's offer were accepted, only $5, 000 of these allocated general overhead costs would be avoided.In addition, the space used to produce part E44 would be used to make more of one of the company's other products, generating an additional segment margin of $21, 000 per year for that product. What would be the impact on the company's overall net operating income of buying part E44 from the outside supplier?

Definitions:

General Journal

A primary accounting record used to record financial transactions that cannot be processed in specialized journals, documenting the full detail of each transaction.

Chart of Accounts

The chart of accounts is a systematic listing of all account titles and numbers used in a company's accounting system, facilitating organization and financial reporting.

Note Receivable

A financial asset representing a promise to pay a specific amount of money, plus interest if applicable, by a certain date or dates.

T-account

A T-account is a visual representation of a general ledger account that outlines a business's debits and credits.

Q7: Dilbert Farm Supply is located in a

Q11: Mciver Corporation uses activity-based costing to assign

Q13: Ort Corporation has provided the following data

Q23: Brannum Corporation has provided the following data

Q43: When using data from a segmented income

Q63: Kudej Printing uses two measures of activity,

Q113: The production department of Tadris Corporation has

Q124: Valotta Corporation has provided the following data

Q164: (Ignore income taxes in this problem. )Juliar

Q216: Johnston Corporation manufactures a single product that