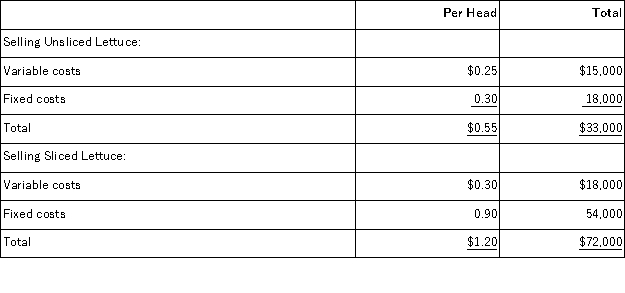

Jebb's Lettuce Stand currently sells 60, 000 heads of lettuce each year for $1.00 per head.Jebb is thinking of expanding operations and serving the customer better by purchasing a "slice and dice" machine that will cut up each head of lettuce into bite-size pieces that can be used for salads.Jebb expects he will then be able to sell his lettuce for $1.70 per head.Jebb has prepared the following analysis for each option based on sales of 60, 000 heads of lettuce:  Based on the information above, what will be Jebb's increase or decrease in profit for the year if he chooses to start slicing up the lettuce instead of selling it whole?

Based on the information above, what will be Jebb's increase or decrease in profit for the year if he chooses to start slicing up the lettuce instead of selling it whole?

Definitions:

Operating Activities

Activities that pertain to the day-to-day operations of a business, generating revenue and incurring expenses through its core business operations.

Financing Activities

Transactions and events that affect the long-term liabilities and equity of a company, such as issuing debt or equity.

Indirect Method

A technique used in cash flow statements where net income is adjusted for non-cash transactions and changes in working capital to arrive at cash flow from operating activities.

Operating Activities

Activities that relate directly to the primary operations of a company, such as sales and service activities, and are reflected in the company's cash flows.

Q7: Dilbert Farm Supply is located in a

Q24: Nantua Corporation has two divisions, Southern and

Q51: Poriss Corporation makes and sells a single

Q56: Routit Corporation had the following sales and

Q77: Criblez Corporation has two divisions: Blue Division

Q80: In activity-based costing, some manufacturing costs can

Q112: Frodic Corporation has budgeted sales and production

Q119: (Ignore income taxes in this problem. )Hinck

Q162: (Ignore income taxes in this problem. )The

Q214: Wragg Urban Diner is a charity supported