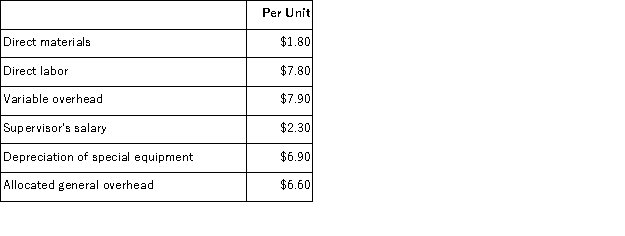

Rama Corporation is presently making part J56 that is used in one of its products.A total of 4, 000 units of this part are produced and used every year.The company's Accounting Department reports the following costs of producing the part at this level of activity:  An outside supplier has offered to produce and sell the part to the company for $30.80 each.If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally. In addition to the facts given above, assume that the space used to produce part J56 could be used to make more of one of the company's other products, generating an additional segment margin of $13, 000 per year for that product.What would be the impact on the company's overall net operating income of buying part J56 from the outside supplier and using the freed space to make more of the other product?

An outside supplier has offered to produce and sell the part to the company for $30.80 each.If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company, none of which would be avoided if the part were purchased instead of produced internally. In addition to the facts given above, assume that the space used to produce part J56 could be used to make more of one of the company's other products, generating an additional segment margin of $13, 000 per year for that product.What would be the impact on the company's overall net operating income of buying part J56 from the outside supplier and using the freed space to make more of the other product?

Definitions:

Secondary Reinforcement

A reinforcing stimulus that acquires its reinforcing power through association with a primary reinforcer.

Tertiary Reinforcement

A type of reinforcement that uses abstract rewards, such as praise or tokens, that can be exchanged for other rewards.

Shaping

A method used in behavioral training where successive approximations of a desired behavior are reinforced.

Successive Approximations

A method in behavior therapy and training in which complex behaviors are broken down into simpler steps, and these steps are learned gradually to achieve the target behavior.

Q19: Ending finished goods inventory in a single

Q48: (Ignore income taxes in this problem. )Swaggerty

Q64: (Ignore income taxes in this problem. )Lajeunesse

Q104: Bevans Corporation is considering a capital budgeting

Q119: Martz Corporation manufactures a single product.The following

Q140: Italia Espresso Machina Inc.produces a single product.Data

Q143: (Ignore income taxes in this problem. )Jason

Q158: The number of units to be produced

Q200: Swifton Corporation produces a single product.Last year,

Q211: Sosinski Corporation has two divisions: Domestic Division