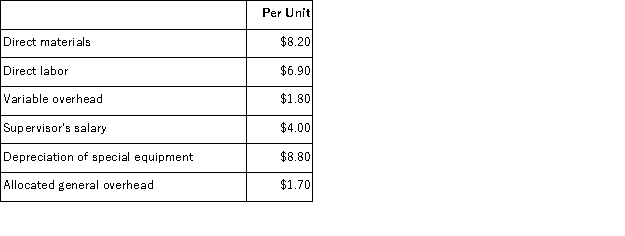

Part O43 is used in one of Scheetz Corporation's products.The company's Accounting Department reports the following costs of producing the 6, 000 units of the part that are needed every year.  An outside supplier has offered to make the part and sell it to the company for $26.40 each.If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company.If the outside supplier's offer were accepted, only $1, 000 of these allocated general overhead costs would be avoided.

An outside supplier has offered to make the part and sell it to the company for $26.40 each.If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company.If the outside supplier's offer were accepted, only $1, 000 of these allocated general overhead costs would be avoided.

Required:

a.Prepare a report that shows the effect on the company's total net operating income of buying part O43 from the supplier rather than continuing to make it inside the company.

b.Which alternative should the company choose?

Definitions:

Favorable

A term often used in budgeting and financial reporting to indicate results that are better than expected or budgeted.

Unfavorable

A term often used in accounting and finance to describe a situation or variance that results in a worse-than-expected financial outcome.

Total Actual Cost

The complete amount spent on a project or production, including direct and indirect costs up to the current point in time.

Variable Overhead Spending Variance

The difference between the actual variable overhead incurred and the standard variable overhead allocated to the actual production achieved.

Q5: (Ignore income taxes in this problem. )Jergenson

Q8: An avoidable cost is a cost that

Q8: Poljak Tech is a for-profit vocational school.The

Q45: In activity-based costing, nonmanufacturing costs are not

Q69: On a cash budget, the total amount

Q79: Rollison Corporation has two divisions: Retail Division

Q92: Yuvil Corporation produces a single product.At the

Q116: Johnston Corporation manufactures a single product that

Q144: Vontungeln Corporation uses activity-based costing to compute

Q164: (Ignore income taxes in this problem. )Juliar