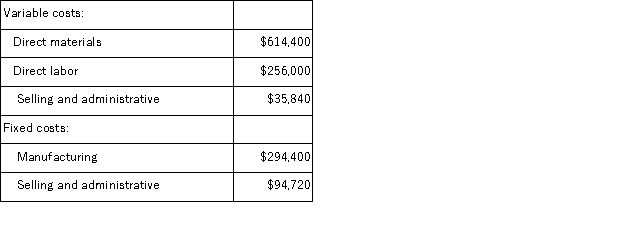

Albertine Co.manufactures and sells trophies for winners of athletic and other events.Its manufacturing plant has the capacity to produce 16, 000 trophies each month;current monthly production is 12, 800 trophies.The company normally charges $113 per trophy.Cost data for the current level of production are shown below:  The company has just received a special one-time order for 1, 200 trophies at $61 each.For this particular order, no variable selling and administrative costs would be incurred.This order would also have no effect on fixed costs.

The company has just received a special one-time order for 1, 200 trophies at $61 each.For this particular order, no variable selling and administrative costs would be incurred.This order would also have no effect on fixed costs.

Required:

Should the company accept this special order? Why?

Definitions:

Trafficked

The movement of people or goods illegally, often involving coercion or deception, for purposes such as forced labor or sexual exploitation.

Profit

The financial gain obtained when the amount earned from a business activity exceeds the expenses, costs, and taxes needed to sustain the activity.

Birth Control Pill

A medication taken orally by women to prevent pregnancy, functioning through the regulation of hormones to inhibit ovulation and other fertility factors.

Tubal Ligation

Tubal Ligation is a surgical procedure for female sterilization involving the sealing, tying, or cutting of the fallopian tubes to prevent eggs from reaching the uterus for fertilization.

Q3: Ginger Corporation uses an activity-based costing system

Q7: (Ignore income taxes in this problem. )Cascade,

Q18: Farron Corporation, which has only one product,

Q21: Crombie Inc.uses a job-order costing system in

Q23: Poriss Corporation makes and sells a single

Q28: When the number of units in work

Q61: Adi Manufacturing Corporation is estimating the following

Q67: Zemlya Corporation currently records $4, 000 of

Q117: Oruro Chemical Corporation manufactures a variety of

Q146: Sarter Corporation is in the process of