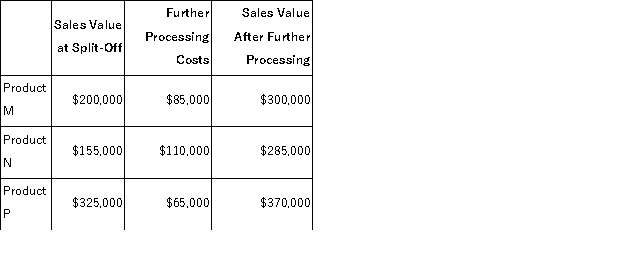

Mitchener Corp.manufactures three products from a common input in a joint processing operation.Joint processing costs up to the split-off point total $300, 000 per year.The company allocates these costs to the joint products on the basis of their total sales value at the split-off point.

Each product may be sold at the split-off point or processed further.The additional processing costs and sales value after further processing for each product (on an annual basis)are:  Required:

Required:

Which product or products should be sold at the split-off point, and which product or products should be processed further? Show computations.

Definitions:

IQ Scores

Numerical measurements derived from standardized tests designed to assess human intelligence and cognitive abilities.

Intelligence Test

A standardized assessment designed to measure a broad range of cognitive abilities and provide an estimate of an individual's intellectual potential.

IQ Tests

Standardized assessments designed to measure human intelligence and cognitive abilities in relation to an age group.

Academic Intelligence

Refers to the intellectual capabilities measured through traditional educational testing and academic achievements.

Q22: Pilgrim Corporation makes a range of products.The

Q24: Adi Manufacturing Corporation is estimating the following

Q49: The following data have been provided by

Q58: Yehle Inc.regularly uses material Y51B and currently

Q70: The project profitability index is computed by

Q81: Gierlach Beet Processors Inc. , processes sugar

Q82: (Ignore income taxes in this problem. )Tangen

Q83: The payback method of making capital budgeting

Q158: Criblez Corporation has two divisions: Blue Division

Q210: Brummitt Corporation has two divisions: the BAJ