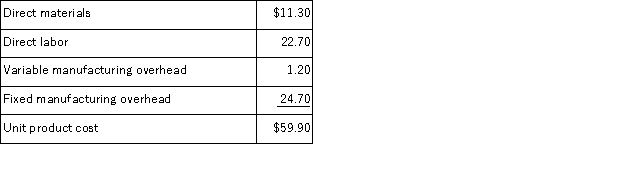

Aholt Corporation makes 40, 000 units per year of a part it uses in the products it manufactures.The unit product cost of this part is computed as follows:  An outside supplier has offered to sell the company all of these parts it needs for $46.20 a unit.If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand.The additional contribution margin on this other product would be $264, 000 per year. If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided.However, $21.90 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier.This fixed manufacturing overhead cost would be applied to the company's remaining products.

An outside supplier has offered to sell the company all of these parts it needs for $46.20 a unit.If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand.The additional contribution margin on this other product would be $264, 000 per year. If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided.However, $21.90 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier.This fixed manufacturing overhead cost would be applied to the company's remaining products.

How much of the unit product cost of $59.90 is relevant in the decision of whether to make or buy the part?

Definitions:

Product Layout

An arrangement of equipment or workstations in the sequence that production operations are performed to manufacture a product.

Process Layout

An arrangement of workplace resources according to the sequence of production tasks, optimizing workflows and efficiency in manufacturing or service processes.

Long-Term Contractual Basis

Refers to agreements or commitments that extend over a prolonged period, usually exceeding one year, governing ongoing relationships or projects.

Component Parts

Individual items or pieces that are assembled with other parts to create a final product.

Q10: Tomek Corporation's activity-based costing system has three

Q25: (Ignore income taxes in this problem. )The

Q41: Correl Corporation has provided the following data

Q43: Duarte Corporation processes sugar beets that it

Q55: Rama Corporation is presently making part J56

Q77: Two alternatives, code-named X and Y, are

Q90: (Ignore income taxes in this problem. )The

Q97: Tetrault Jeep Tours operates jeep tours in

Q125: Ravelo Corporation has provided the following data

Q131: (Ignore income taxes in this problem. )Peter