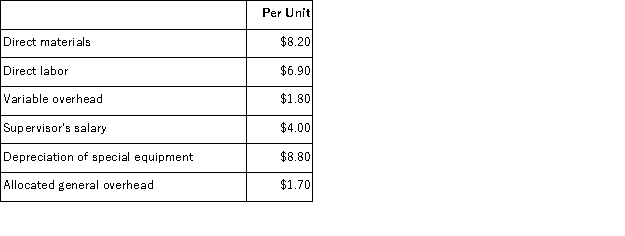

Part O43 is used in one of Scheetz Corporation's products.The company's Accounting Department reports the following costs of producing the 6, 000 units of the part that are needed every year.  An outside supplier has offered to make the part and sell it to the company for $26.40 each.If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company.If the outside supplier's offer were accepted, only $1, 000 of these allocated general overhead costs would be avoided.

An outside supplier has offered to make the part and sell it to the company for $26.40 each.If this offer is accepted, the supervisor's salary and all of the variable costs, including direct labor, can be avoided.The special equipment used to make the part was purchased many years ago and has no salvage value or other use.The allocated general overhead represents fixed costs of the entire company.If the outside supplier's offer were accepted, only $1, 000 of these allocated general overhead costs would be avoided.

Required:

a.Prepare a report that shows the effect on the company's total net operating income of buying part O43 from the supplier rather than continuing to make it inside the company.

b.Which alternative should the company choose?

Definitions:

Compound Annual Rate

The rate at which an investment grows annually when interest is reinvested to earn additional interest.

Nominal Rate

The interest rate before adjustments for inflation or other factors, often referred to as the stated or face interest rate.

Compounded Quarterly

A method of calculating interest where the accrued interest is added to the principal sum every quarter, thus increasing the base for the next interest calculation.

Nominal Rate

The quoted interest rate on a loan or investment, not adjusting for the effect of compounding or inflation.

Q4: Hatfield Corporation, which has only one product,

Q5: Vanikord Corporation currently has two divisions which

Q6: Benoist Corporation has an activity-based costing system

Q65: The WRT Corporation makes collections on sales

Q67: Morrish Inc.bases its manufacturing overhead budget on

Q68: (Ignore income taxes in this problem. )The

Q96: Tondre Inc.has provided the following data for

Q129: Aaker Corporation, which has only one product,

Q152: (Ignore income taxes in this problem. )Westland

Q167: Which of the following is NOT an