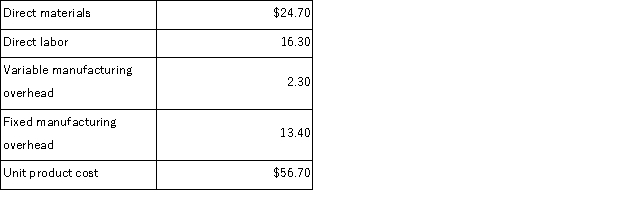

Foster Company makes 20, 000 units per year of a part it uses in the products it manufactures.The unit product cost of this part is computed as follows:  An outside supplier has offered to sell the company all of these parts it needs for $51.80 a unit.If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand.The additional contribution margin on this other product would be $44, 000 per year.

An outside supplier has offered to sell the company all of these parts it needs for $51.80 a unit.If the company accepts this offer, the facilities now being used to make the part could be used to make more units of a product that is in high demand.The additional contribution margin on this other product would be $44, 000 per year.

If the part were purchased from the outside supplier, all of the direct labor cost of the part would be avoided.However, $5.10 of the fixed manufacturing overhead cost being applied to the part would continue even if the part were purchased from the outside supplier.This fixed manufacturing overhead cost would be applied to the company's remaining products.

Required:

a.How much of the unit product cost of $56.70 is relevant in the decision of whether to make or buy the part?

b.What is the net total dollar advantage (disadvantage)of purchasing the part rather than making it?

c.What is the maximum amount the company should be willing to pay an outside supplier per unit for the part if the supplier commits to supplying all 20, 000 units required each year?

Definitions:

E-Procurement

The use of online systems and tools to conduct the purchasing process and acquire goods and services for a business, aiming to improve efficiency and reduce costs.

Auctions

Competitive bidding processes where goods or services are sold to the highest bidder.

Internet Purchasing

The process of buying goods and services online, leveraging digital platforms and e-commerce websites for transactions.

Negotiation Strategies

Approaches taken by supply chain personnel to develop contractual relationships with suppliers.

Q3: Nantua Corporation has two divisions, Southern and

Q8: Data for March for Lazarus Corporation and

Q24: Nantua Corporation has two divisions, Southern and

Q44: The book value of old equipment is

Q51: Cervetti Corporation has two major business segments-East

Q65: (Ignore income taxes in this problem. )Overland

Q70: The project profitability index is computed by

Q128: Roberts Corporation manufactures home cleaning products.One of

Q141: Laguna Corporation has provided the following data

Q189: When using segmented income statements, the dollar