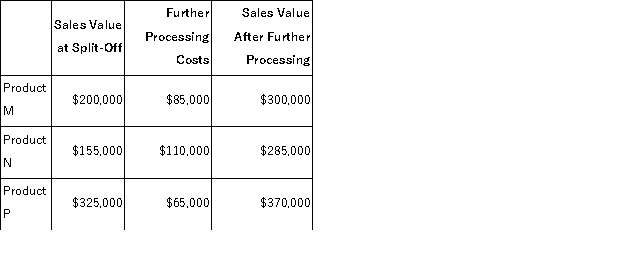

Mitchener Corp.manufactures three products from a common input in a joint processing operation.Joint processing costs up to the split-off point total $300, 000 per year.The company allocates these costs to the joint products on the basis of their total sales value at the split-off point.

Each product may be sold at the split-off point or processed further.The additional processing costs and sales value after further processing for each product (on an annual basis)are:  Required:

Required:

Which product or products should be sold at the split-off point, and which product or products should be processed further? Show computations.

Definitions:

Stimulus

A change in the environment that influences or prompts a response in an organism.

Display

In social science, it refers to the expression or presentation of emotions or behaviors intentionally or unintentionally in social settings.

Stabilize

To make or become unlikely to change, fail, or decline.

Physical World

The realm of material objects, natural phenomena, and the universe's physical properties, excluding thoughts and consciousness.

Q3: Nantua Corporation has two divisions, Southern and

Q25: The following information relates to Marter Manufacturing

Q39: Chuang Corporation's activity-based costing system has three

Q46: The costs of idle capacity should be

Q61: Caber Corporation applies manufacturing overhead on the

Q72: Opportunity costs are not usually recorded in

Q94: Kosco Corporation produces a single product.The company's

Q137: When using internal rate of return to

Q142: Budgeted sales in Acer Corporation over the

Q149: Cowles Corporation, Inc.makes and sells a single