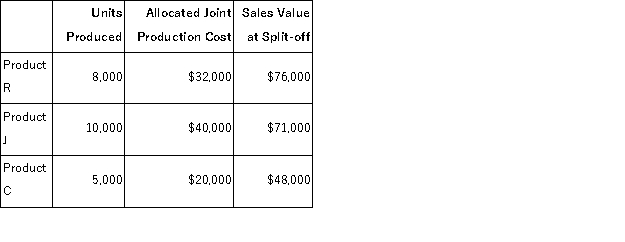

Benjamin Signal Company produces products R, J, and C from a joint production process.Each product may be sold at the split-off point or be processed further.Joint production costs of $92, 000 per year are allocated to the products based on the relative number of units produced.Data for Benjamin's operations for the current year are as follows:  Product R can be processed beyond the split-off point for an additional cost of $26, 000 and can then be sold for $105, 000.Product J can be processed beyond the split-off point for an additional cost of $38, 000 and can then be sold for $117, 000.Product C can be processed beyond the split-off point for an additional cost of $12, 000 and can then be sold for $57, 000.

Product R can be processed beyond the split-off point for an additional cost of $26, 000 and can then be sold for $105, 000.Product J can be processed beyond the split-off point for an additional cost of $38, 000 and can then be sold for $117, 000.Product C can be processed beyond the split-off point for an additional cost of $12, 000 and can then be sold for $57, 000.

Required:

Which products should be processed beyond the split-off point?

Definitions:

Equality In Relationship

A state of being equal in rights, responsibilities, and opportunities within interpersonal relationships, promoting fairness and mutual respect.

Career Interest

Refers to the specific professions or fields a person feels drawn to or passionate about pursuing.

Lesbian

A woman who is romantically or sexually attracted to other women.

Bisexual Couples

refers to romantic or marital partnerships where one or both individuals identify as bisexual, being attracted to both their own gender and other genders.

Q5: Kapanga Manufacturing Corporation uses a job-order costing

Q34: Lake Corporation has an activity-based costing system

Q38: Meyer Corporation has two sales areas: North

Q81: Zumbrunnen Corporation uses activity-based costing to compute

Q94: Edgington Inc.bases its manufacturing overhead budget on

Q98: Acton Corporation, which applies manufacturing overhead on

Q116: (Ignore income taxes in this problem. )Beaver

Q119: Foradori Corporation's activity-based costing system has three

Q159: (Ignore income taxes in this problem. )Avanca

Q195: Pratt Corporation has two major business segments-Apparel