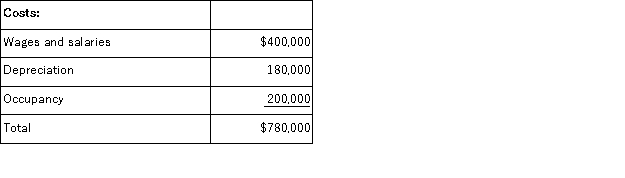

Duerr Corporation uses an activity-based costing system with three activity cost pools.The company has provided the following data concerning its costs:  The distribution of resource consumption across the three activity cost pools is given below:

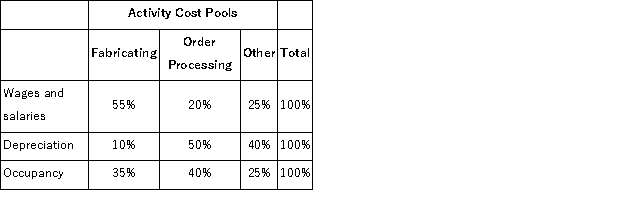

The distribution of resource consumption across the three activity cost pools is given below:  How much cost, in total, would be allocated in the first-stage allocation to the Order Processing activity cost pool?

How much cost, in total, would be allocated in the first-stage allocation to the Order Processing activity cost pool?

Definitions:

Depreciation

Depreciation is the accounting process of allocating the cost of a tangible asset over its useful life, reflecting its decrease in value over time.

Income Taxes

Taxes levied by the government on individuals or corporations based on their net income or profit.

Value Of Dollar

The purchasing power of the U.S. dollar, influenced by factors such as inflation, interest rates, and economic conditions.

Q8: Data for March for Lazarus Corporation and

Q17: Weston Corporation is considering eliminating a department

Q39: The following are budgeted data for the

Q83: The following data were provided by Rider,

Q144: The Gerald Corporation makes and sells a

Q153: (Ignore income taxes in this problem. )Chee

Q178: The principal difference between variable costing and

Q191: A manufacturing company that produces a single

Q194: Because absorption costing emphasizes costs by behavior,

Q218: Last year, Hruska Corporation's variable costing net