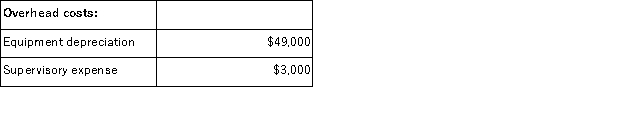

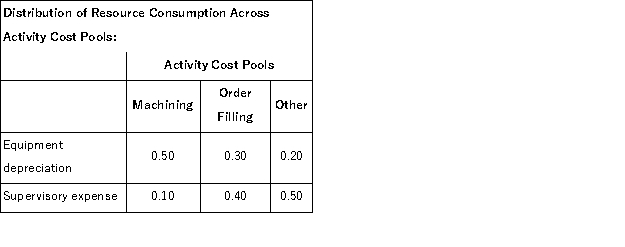

Betterton Corporation uses an activity based costing system to assign overhead costs to products.In the first stage, two overhead costs-equipment depreciation and supervisory expense-are allocated to three activity cost pools-Machining, Order Filling, and Other-based on resource consumption.Data to perform these allocations appear below:

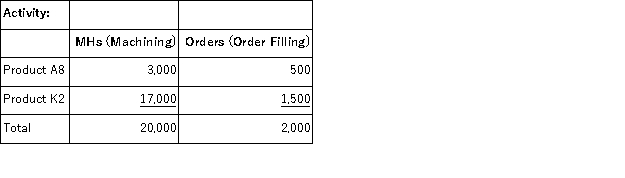

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:  How much overhead cost is allocated to the Machining activity cost pool under activity-based costing in the first stage of allocation?

How much overhead cost is allocated to the Machining activity cost pool under activity-based costing in the first stage of allocation?

Definitions:

Qualitative Variables

Variables that express categorical data and can be described or classified by qualities rather than numerical measures.

Contingency-table Test

A statistical test used to determine whether there is a significant association between two categorical variables.

Expected Cell Frequency

In the context of a contingency table, it is the number of observations expected in a cell based on the hypothesis being tested.

Chi-square Test of Independence

The Chi-square Test of Independence is a statistical test used to determine if there is a significant relationship between two categorical variables.

Q11: A manufacturing company that produces a single

Q32: Vassallo Corporation's activity-based costing system has three

Q46: Job 397 was recently completed.The following data

Q63: The cost of goods sold in a

Q69: On a cost-volume-profit graph, the revenue line

Q102: Bowdish Corporation purchases potatoes from farmers.The potatoes

Q124: Valotta Corporation has provided the following data

Q136: The direct labor budget of Faier Corporation

Q205: Warburton Corporation has two divisions: Alpha and

Q208: A manufacturing company that produces a single