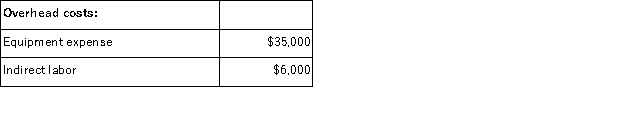

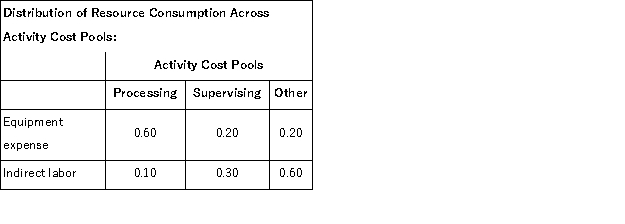

Manton Corporation uses an activity based costing system to assign overhead costs to products.In the first stage, two overhead costs-equipment expense and indirect labor-are allocated to the three activity cost pools-Processing, Supervising, and Other-based on resource consumption.Data to perform these allocations appear below:

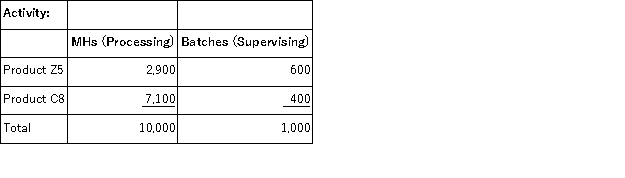

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:  The activity rate for the Processing activity cost pool under activity-based costing is closest to:

The activity rate for the Processing activity cost pool under activity-based costing is closest to:

Definitions:

Elephant Preservation

Efforts and activities dedicated to saving elephants from threats such as poaching and habitat destruction, aiming to ensure their survival and wellbeing.

Governments

The organization, or system of organizations, responsible for governing a community, region, or country, typically with the authority to enact and enforce laws.

Overtaxed

The condition of being subject to excessive tax rates, leading to financial burden or disincentive for economic activity and investment.

World's Land Area

Refers to the total surface area of the Earth that is covered by land.

Q35: Kampmann Corporation is presently making part Z95

Q48: (Ignore income taxes in this problem. )Swaggerty

Q88: Manton Corporation uses an activity based costing

Q103: Aaker Corporation, which has only one product,

Q103: The Clyde Corporation's variable expenses are 35%

Q129: Carter Lumber sells lumber and general building

Q130: Sarter Corporation is in the process of

Q133: The margin of safety in dollars equals

Q172: A study has been conducted to determine

Q181: Pevy Corporation has two divisions: Southern Division