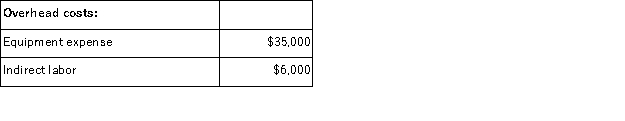

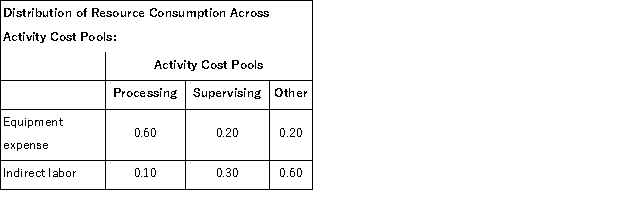

Manton Corporation uses an activity based costing system to assign overhead costs to products.In the first stage, two overhead costs-equipment expense and indirect labor-are allocated to the three activity cost pools-Processing, Supervising, and Other-based on resource consumption.Data to perform these allocations appear below:

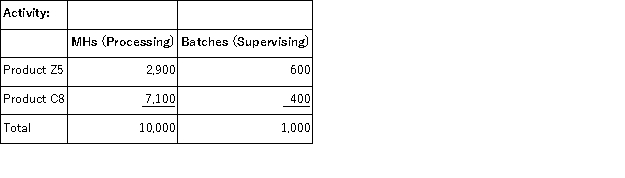

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches.The costs in the Other activity cost pool are not assigned to products.Activity data for the company's two products follow:  What is the overhead cost assigned to Product Z5 under activity-based costing?

What is the overhead cost assigned to Product Z5 under activity-based costing?

Definitions:

Married Taxpayers

Individuals who are legally married and may choose to file income tax returns jointly or separately.

Dependents

Individuals, typically family members, who rely on another person, usually the primary earner, for financial support.

Taxable Income

The portion of income upon which tax is owed, calculated by subtracting allowable deductions from gross income.

Married Taxpayers

Individuals who are married and may choose to file joint or separate income tax returns.

Q2: (Ignore income taxes in this problem. )DE

Q42: Chibu Corporation is a single product firm

Q53: (Ignore income taxes in this problem. )Frick

Q54: Koutz Corporation uses activity-based costing to compute

Q70: The project profitability index is computed by

Q73: Tondre Inc.has provided the following data for

Q83: Activity-based management seeks to eliminate waste by

Q88: Moonen Corporation produces and sells a single

Q92: Yuvil Corporation produces a single product.At the

Q108: During its first year of operations, Carlos